Flavors of the Month

The Historical Performance of the Brass Chronomètre a Résonance

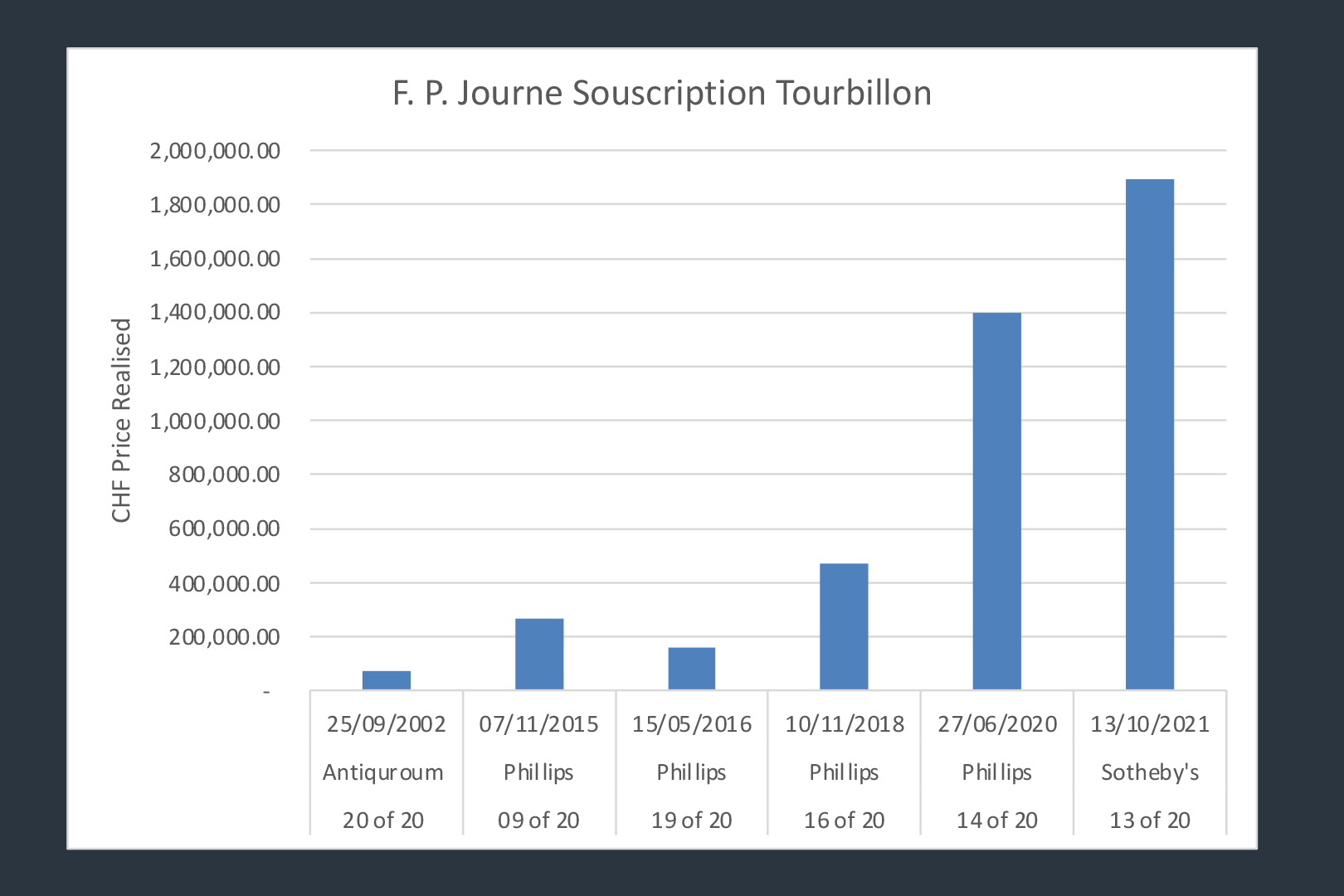

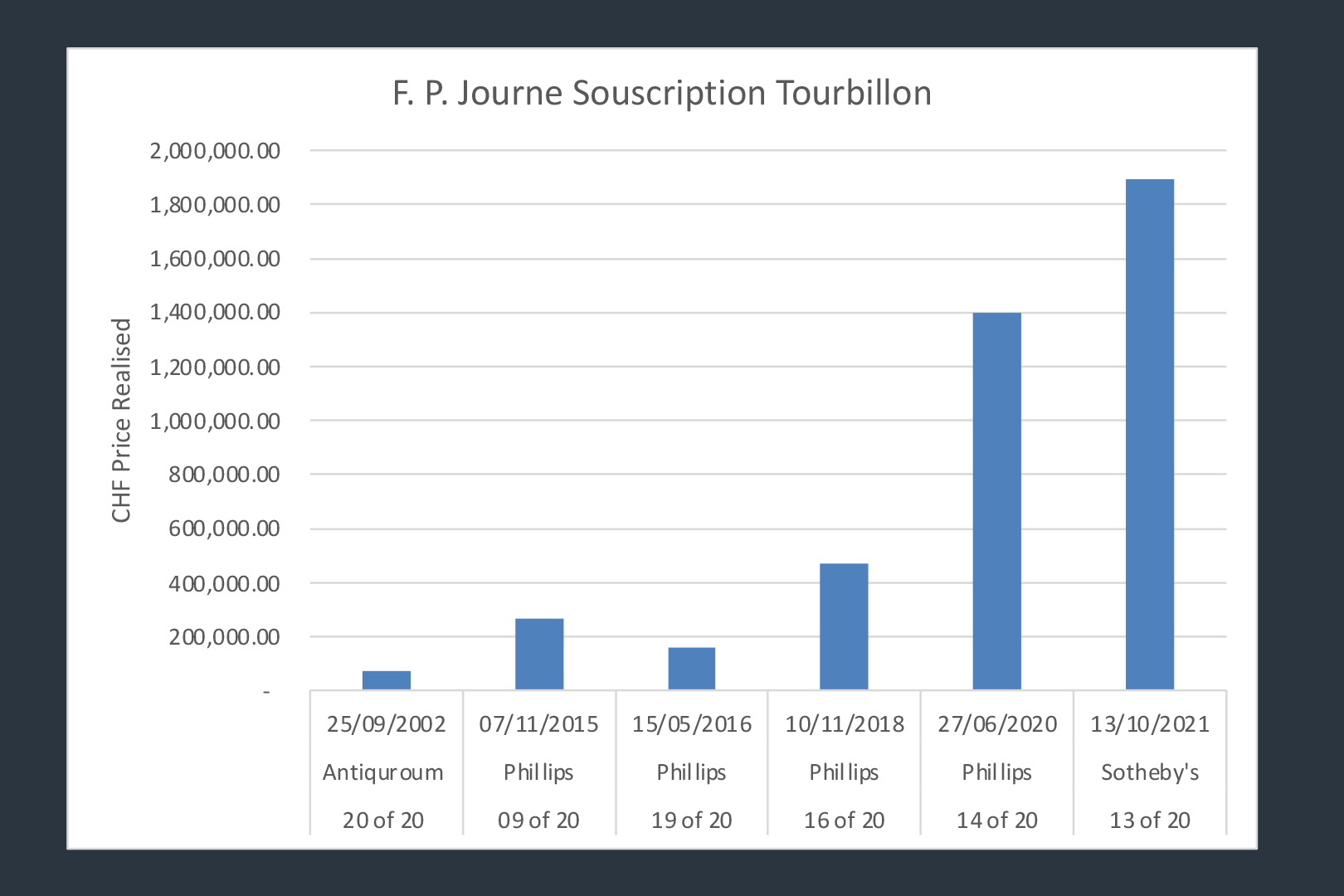

By adminThe year is 2002, the brand F. P. Journe is only ‘three’ years old and surprisingly already launched three remarkable references, Tourbillon Souverain, Chronomètre a Résonance, and the Octa Reserve de Marche. By this time all Souscription Tourbillons had been produced and delivered to their respective owners. The importance of Souscription Tourbillon’s is not necessarily understood by the world, yet. On the 25th of September 2002, Antiquorum, the leading auction house solely dedicated to haute horology, had a particular Tourbillon Souscription for sale (lot 419). This particular example was none other than the last number of the series, 20/20. Described as “No. 20/20, produced in a limited edition of 20 examples in 2000 … Very fine and rare, platinum gentleman’s chronometer wristwatch with one minute Tourbillon regulator and constant force”. The then relatively unrecognised Tourbillon Souscription had just hammered for $50’600 (CHF 75’507.50). Considering the retail price was CHF 27’000 (excluding swiss VAT) in 1998, it would indicate that Souscription No. 20/20, did in fact sell above its retail price. That is not entirely accurate, it is important to acknowledge that Tourbillon Souscription was sold at 50% off its future retail price. In 2002, the retail price of the ‘ordinary’ platinum cased Tourbillon Souverain was $59’000. Since then the landscape of collecting F. P. Journes has fundamentally changed.

Certain collectors argue that the market was cannibalised by preowned-dealers, others argue that certain pieces were grossly undervalued as they traded heavily below their retail prices. For example on the 5th of April 2004, Sotheby’s sold a brass 38mm platinum case paired with a yellow dial Chronomètre a Résonance for $27’000 against the remarkably low estimate of $10’000 – $15’000. It is interesting to note back in 2004 when F. P. Journe introduced 18-carat gold movements which were marginally more expensive than the brass movements, collectors would tend to opt for brass movements on the preowned market since they were cheaper.

The lack of readily available Résonances at auction from 2017 to 2019 probes various theories behind this hiatus, one of which could be that a rather large preowned platform went after all the brass-based movements. Another possible theory is that collectors identified the importance of the brass pieces, additionally, the 38mm cases were phased out in 2015, this could have also played a factor. Lastly, the 20% acquisition of F. P. Journe by the Wertheimer brothers resulted in an official announcement on the 14th of September 2018 … this may have opened the doors for an entirely new genre of collectors.

To identify the catalyst behind this sudden surge in prices one must argue for and against the possible theories stated below:

A summary of the plausible theories:

- An Auction House Hiatus – lack of readily available brass Résonances

- A rather large preowned platform targeted specific brass based F. P. Journe’s

- The discontinuation of the 38mm case size in 2015

- On the 14th of September 2018, Montres Journe officially announced that the Wertheimer brothers acquired a 20% stake in the business, recognition of his work.

- Unique Pieces – Only Watch / Action Innocence

Auction House Theory

In 1974 Gabriel Tortella founded his auction house named la Galerie Genevoise, several years later Osvaldo Patrizzi joined the picture as a partner. In 1981 the partnership ended and la Galerie Genevoise was renamed Antiquorum. In doing so Osvaldo Patrizzi was a pioneer in the commercialisation of haute horology through auctions founded Antiquorum one of the very first auction houses dedicated to horology in 1974. As a result, the earliest known F. P. Journe auction results are usually found at Antiquorum. According to our knowledge, Antiquorum is the only auction house that the brand, F. P. Journe, has ever collaborated with. In order to commemorate Antiquorums 30 year anniversary, F. P. Journe donated 3 unique Vagabondage 1’s in white gold, yellow gold, and platinum signed “30 Years of Antiquorum”. From 2003 till 2006, 11 brass résonances were sold, out of which 3 were part of the Ruthenium Series. As the transition from the brass-to-gold movements occurred during that period, it might potentially indicate that collectors preferred the updated movement in gold along with the optional enlarged 40mm case. Antiquorum managed to cross the $50’000 threshold six times, out of which four form part of the Ruthenium limited edition. The breakout result on the 8th December 2010 is not entirely accurate as this was a set of six brass pieces bearing the unique serial no. 1000. From 2016 onwards Antiquorum has not had a brass résonance for sale.

The average price of a brass résonance (irrespective of the configuration) achieved at Sotheby’s averages out to $36’851, if we include both results on the 29th of April 2020 and 11th November 2020, the average shifts to $63’296. The $50’000 threshold was not crossed until 2020, upon further investigation it would appear that Sotheby’s did not sell a brass Résonance between 02/10/2017 till 28/04/2020, a substantial gap of 939 days. By pure coincidence, the watch sold on the 2nd October 2017 (292-03R) and the 29th of April 2020 (291-02R), are within a serial number of each other. Both examples feature platinum cases although the dials differ. It remains rather interesting to witness the breakout result on the 29th of April 2020 which surpassed the $200’000 mark for the very first time at Sotheby’s and sold for $209’670.

In total Christies sold 25 Brass Résonances, we opted to include the Opus Series which sold for $79’660 on the 28th of May 2018, as it is classified as a brass movement. The average price of a brass résonance (irrespective of the configuration) achieved at Christies’ averages out to $51’374, if we include both results on the 23rd November 2019 and 19th November 2020, the average shifts to $71’743. Similar to other auction houses it would appear that the Ruthenium Résonance outperforms the ‘regular’ brass-based résonances. If we opt to remove the Opus Series from our data, there would then be a period from 27/11/2017 till 23/11/2019, 726 days, whereby no brass Résonance appeared at Christie’s.

The result on the 23rd of November 2019 sent ripples through the F. P. Journe market, from our understanding a seasoned collector knew exactly how special this particular piece was. The monumental result, $255’595, signified an immediate turning point for the F. P. Journe market and is one of the catalysts behind the newfound prices for F. P. Journe watches.

In 2015 the newly formed watch depart at Phillips, in association with veterans Bacs and Russo, also proved to have a significant impact on the F. P. Journe market. Under Bacs and Russo, Phillips is the only auction house to have successfully sold 4 Souscription Tourbillons. The importance of those results cannot be quantified, they essentially form the backbone of the entire F. P. Journe market. Phillips was the only auction house that was able to attract a Brass Résonance for its sale in 2018 albeit the piece was a Ruthenium example. If we do not include the Ruthenium example, it would result in Phillips not having sold a Brass Resonance from 11/11/2017 till 28/06/2020, 960 days. Following a similar trend to the other auction houses.

The data supports the theory that there seemed to be a lack of brass résonances from 2017 till 2019/20. The trajectories of the brass Résonance seem to be virtually in sync (no pun intended) between all leading auction houses, the catalysts being the Christie’s result on the 23rd November 2019, lot 2241 sold for $255’595. The example that was sold featured a 38mm platinum case paired with a remarkably early dial and consistent shallow hallmarks (044-00R). This marked the very first time any auction house surpassed the $200’000 barrier. Since then no brass Résonance has sold below the $200’000 mark, irrespective of how ‘early’ or ‘standard’ the piece is. After its 960 day hiatus, Phillips, announced that they would be selling the first known Souscription Résonance along with its matching Tourbillon Souscription, this sparked renewed interest in a relatively unknown era of F. P. Journe’s history. The Souscription Résonance is believed to have been offered to the original collectors of the Tourbillon Souscription, out of which a handful have matching sets. This also marked the first time a two-tone Souscription has ever come up publicly. Phillips opted to split the set across two lots, the first being the Souscription Résonance followed by the Souscription Tourbillon. These two lots essentially encapsulated one of F. P. Journe’s most important pieces, we do not think such an opportunity will present itself in the future (to obtain a matching set during a single auction). As a result, Phillips broke the $1’000’000 barrier for the historically significant Souscription Résonance. In rather quick succession Phillips managed to offer another Souscription Résonance (004-00R, lot 102) in its December New York 2020 Sale, this brought in a disappointing $403’200, some argue that the dial change did not help and others argue that the auction theme did not suit such a piece. Considering Phillips sold a relatively ‘ordinary’ brass Résonance (215-02R) in November of 2020 for $392’043 it would seem that the result of $403’200 was considerably low.

Blame the preowned dealer

We have heard collectors discuss the preowned dealer theory over and over again. The story is the following, a rather large preowned platform founded by three dynamic partners along with private equity passively built a relatively strong position in F. P. Journe. Whilst we cannot ascertain how large of a position this platform currently possess, we do know that they have been active within the F. P. Journe market much before it was a la mode. They also created F. P. Journe content before it was commercially viable to do so. In essence, they supported the market at a time when not many others did, in turn, that allowed them to buy certain pieces well below the fair market value. As the market fundamentals shifted from 2017 to 2019, this platform was a direct beneficiary of the astronomical shift in prices. In parallel, collectors who held on to their F. P. Journe watches from 2001 till 2017 were barely exposed to any capital gains. As the market fundamentals shifted, certain collectors decided it was the right time to exit the market. Due to the rather small production output of F. P. Journe, it was not difficult for certain references to skyrocket, similar to the auction results. At a certain point, there seemed to be a knowledge gap between the fair market values for certain references. Today, it is relatively fair to say that most current F. P. Journe owners and future owners are relatively well informed. For a platform to mimic what this particular player did would virtually be impossible. A plausible sub-theory could be that this particular platform sped-up this ‘recognition’ phase exponentially, at the same time this has only made it that much more difficult for this platform and others alike to source F. P. Journes.

38mm Phased Out

In 2015, F. P. Journe waved goodbye to the 38mm, the then least sought after case size. The symbolic 38mm case size formed part of the core collection since the brand was founded. In order to pay tribute to this case size, F. P. Journe decided to create a set of 5 steel watches in 38mm. The decision to discontinue the 38mm case was a natural one based on the weak demand for the 38mm cases. In turn, this led to the creation of the 42mm which was aimed at people with larger wrists.

The psychological aspect of wanting something you cannot have is a known issue. The cause and effect of discontinuing the 38mm case size are rather interesting. Upon the official release of its discontinuation in 2015, retailers and boutiques most probably still had 38mm pieces in stock. The sudden disappearance of the 38mm cases did not happen overnight, it was rather a gradual procedure. As retailers sold their last pieces, so did boutiques and thereafter so did the preowned market. The general consensus of collectors was the 38mm cases were more proportional, this consensus became mainstream once the 38mm cases were discontinued. In tandem, all brass movements are housed in 38mm cases (apart from the Octa Zodiaque). The effect of no longer having 38mm cases only added fuel to the fire.

As of 2021, it would appear that F. P. Journe reworked the proportions of certain references such as the Octa Lune, the updated bezel would suggest that it is much thinner than previous examples.

Ownership

On the 14th of September 2018, Montres Journe SA, officially confirmed that 20% of the business was sold to the Wertheimer brothers. In a recent interview conducted by our friend SJX, François-Paul shared the following:

In the beginning there were three shareholders, and now there’s a fourth one. It doesn’t change anything about the future of the company. If something happens to me, it protects our children from external predators. So now they’re out; all those big groups like LVMH, Richemont, Kering, Swatch Group – they can’t buy us anymore. I chose the owners of Chanel because they are big watch collectors and also very good friends. Chanel is also a company that is not on the stock market. It’s a 100% family business, and they don’t make a lot of mistakes in their way of working. If our children were to sell the company to Richemont or another group, the brand would die in 10 years.

Unique Pieces

The opportunity to own a unique F. P. Journe does not present itself often. In order to support meaningful research, the brand is known to donate unique pieces for fitting occasions. Only Watch and Action Innocence are two of Journe’s preferred charities.

The performance of unique piece F. P. Journe’s has been rather stellar, for example on the 7th November 2015 the Unique Tourbillon Souverain Bleu sold for CHF 550’000, an impressive result for an F. P. Journe back then, although this was not the most expensive F. P. Journe sold publicly. Back then The Purple Tourbillon Souverain donated to Action Innocence held the record for the most expensive F. P. Journe which sold for a record CHF 650’000 albeit largely thanks to the ever-gracious underbidder who donated his losing bid.

Since then several other unique pieces have surfaced, the most impressive being the Unique Tantalum Prototype Astronomic that sold for $1’800’000 in 2019 at Only Watch, this marked the most expensive F. P. Journe wristwatch ever sold publicly. The remarkable performances of the Souscription Résonance/Tourbillon along with unique pieces form the backbone of the auction market.

Closing Remarks

The one question that irked François-Paul was his long-term succession planning past his days and those of his current partners. As of the 14th September 2018, the looming cloud over the head of François-Paul vanished. This alliance with Chanel essentially protects the future and integrity of the manufacture and avoids the possibility of the brand falling into the wrong hands. In turn, this strategic move instilled confidence across every single collector. This inadvertently propelled the brand into the spotlight and resulted in newfound interest from rather important collectors.

In the Art World, it is fairly common for an artist’s work to become recognised and appreciated after his or her passing. In the world of independent watchmaking, which is a relatively new concept, this theory is rather unproven. The finest example would be the late Sir. George Daniels, a pioneer/godfather in the independent watchmaker sphere. Prior to his passing his work had already been fairly recognised and appreciated and valued by collectors as well as enthusiasts. Today, some of his pieces have crossed the $1’000’000 mark our friends over at A Collected Man sold a unique Tourbillon for over $1’200’000. The legacy left behind by Sir Dr. Daniels has only been enhanced by his charitable foundation and through his apprentice and now renowned watchmaker Sir Roger Smith. On the other hand, certain watchmakers such as Derek Pratt never achieved recognition. Pratt’s work was instrumental in the formation of the co-axial escapement, today his legacy is not entirely fitting … it was recently announced that the Derek Pratt Watches LLC would create their own watch. Time will only tell if his legacy will be honored.

The path to François-Paul’s success was not achieved overnight, his determination paired with his unbelievable talent has led to this new-found recognition phase. François-Paul played the long game, a fitting quote would be the following: “the ability to discipline yourself to delay gratification in the short term in order to enjoy greater rewards in the long term is the indispensable prerequisite for success”. Without a doubt the theories discussed above all played a key role in achieving the recognition phase, it is difficult to ascertain which theory is the single most important, as this is entirely subjective. We would argue that the historical prices realised by Souscription Tourbillons as well as Christies result of November 2019 and securing the legacy of F. P. Journe’s vis-à-vis the Wertheimer brothers all played a fundamental role in arriving where we are today.